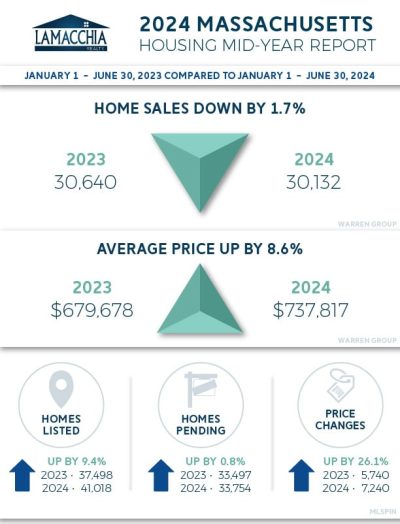

This Lamacchia Mid-Year Housing Report presents overall home sale statistics as of the first six months of 2024 compared to the same period last year, January 1st to June 30th, 2023. Highlighted in this report are the average sale prices for single-family, condominiums, and multi-family homes in Massachusetts along with the number of homes listed for sale, placed under contract, and price adjustments.

Number of Homes Sold Decreased by 1.7%

Home sales for single families, condos, and multi-families decreased with 30,132 closing in the first half of 2024 compared to 30,640 in the first half of 2023.

- The number of sales decreased in single families and condos: down by 0.8% for singles, and down 4.5% for condos. Multi-family sales increased by 2.2%.

- Although the market exhibited decreases in sales in the first half of 2024, the changes were nominal compared to the mid-year of 2023 when sales were down 24.8% overall.

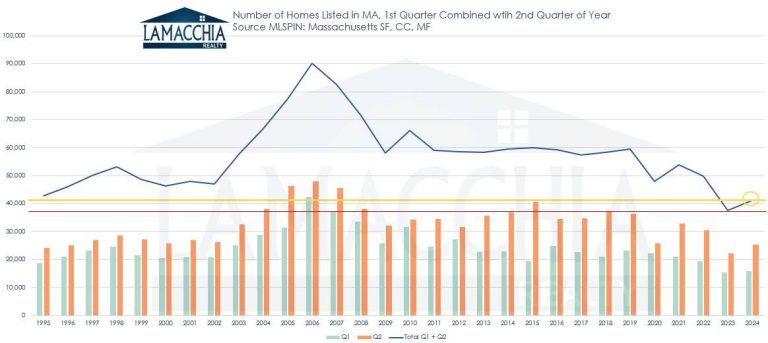

- Inventory is up, as you can see in the chart to the right, the yellow line

depicting 2024 which has been higher than 2023 (purple line) from late winter until present day.

depicting 2024 which has been higher than 2023 (purple line) from late winter until present day. - Last year depicted the lowest number of homes listed in two decades, so this year is the start of the market rebalancing itself.

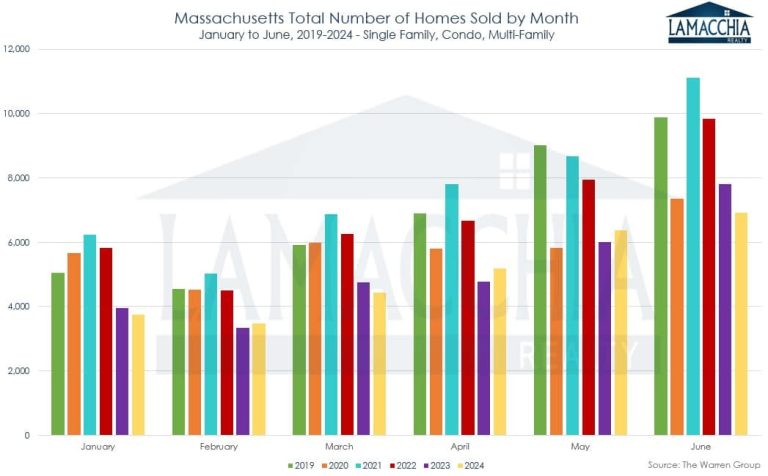

- Review the graph below, monthly sales in 2023 and 2024 were neck in neck as half the time 2023 sales beat 2024, and vice versa for the other half, with 2024 coming in lower overall by 1.7%. The pre- and post-pandemic sales levels (2019-2022) were at a level of their own, and we are likely to be slightly rising back up to that point over the next few years as the market recovers.

Prices Increase 8.6%

Prices increased in all three categories in the first half of 2024 over the same period last year. The average price for all three categories combined is up to $737,817 over last year at this same time period which was at $679,678.

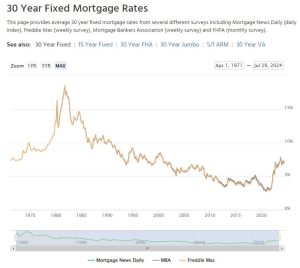

- This is great news for homeowners and sellers, but not particularly helpful for buyers, as mortgage rates hovering in the high 6%-low 7% range can make a monthly mortgage payment challenging.

- Single family average prices are up 9.6% to $770,648, condo prices are up 5.8% to $682,591, and multi-families are up 9.1% to $697,015.

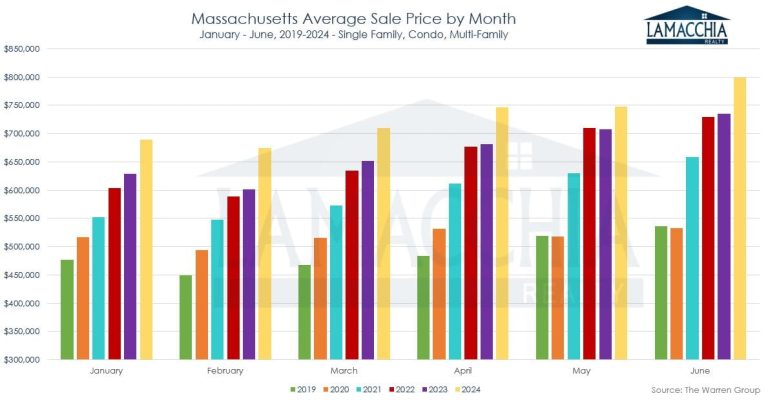

- Average prices in Massachusetts have been steadily, and at times rapidly rising, for years and this year is no exception. 2023 was an outlier with only a nominal increase, but they accelerated once again in 2024!

- Sellers are having to list their homes at competitive prices as they have to address that buyer affordability is at an all-time low with prices still higher than they’ve ever been and rates consistently resting in the high 6% – low 7% range – much higher than the 3% during the pandemic. An indicator of this phenomenon is that price changes are up 26.1% over this time last year.

- In the chart below, you can see that over the past four years, prices have steadily gained over prior years and 2024 is no exception. Last year was the outlier in the first two quarters with only sight overall increases.

- The rates as they have been over the past year, in the 6%-7% range, historically aren’t that high and could seem relatively normal as time goes on, something we are already beginning to see. Waiting for rates to drop could potentially cost you more in the long run. If you find the house that suits your needs and is within your budget, it may make sense to buy it now. If rates drop, there’s the potential to refinance in most cases. However, there are many buyers on the sidelines who will be able to take advantage of lower rates and this increased demand will put further pressure on prices.

Homes Listed for Sale in MA

There were 41,018 new active listings in the first half of 2024 compared to 37,498 last year, a very welcome 9.4% increase.

- This time last year we published a report on how the number of new listings in the first half of 2023 was the lowest in recorded history, since 1995. You’ll see how in the chart below, the red line depicts 2023 as the lowest year, and this year, in yellow, is higher than that, but still lower than any other year. This is good news for buyers as it indicates higher supply.

- This increase over last year shows clearly that though a lot of sellers want to hold onto their pandemic-level rates, life changes take priority, and making moves is not always a choice. Divorce, family growth, empty nesters, relocations, and job/income fluctuations all precipitate buyers having to buy and sellers having to sell.

- In cases where interest rates pose a significant obstacle for buyers seeking more budget-friendly monthly payments, it’s worth considering various alternative options like mortgage buydowns or assumptions.

- New listings are an indicator of future pending sales, so with this number up, we will hopefully see higher pending sales into the fall.

Pending Home Sales (contracts accepted)

The number of homes placed under contract increased by 0.8% year over year with 33,754 pending sales over 33,497 last year this time.

- With both listings and inventory up, buyers have had more of a chance to buy and therefore, pending sales have risen a bit. Despite the welcome sign of an increase, it’s nominal compared to years past, and the market is still tight.

- Pending sales are a future indicator of closed sales and with pending sales up, we could see a slight rise in sales into the fall.

Predictions for the Rest of the Year

Similar to other New England states and the national trend, the Massachusetts real estate market has experienced a decrease in the number of sales accompanied by an increase in prices.

Some sellers are still hesitant to list their properties because they secured low interest rates during the Covid era, making it difficult to accept the current rates of around 7%. However, with an increase in listings, we are seeing homeowners in real time move on from the idea of those lower rates when faced with necessity or significant life changes.

Demand for those homes has continued to prop up home prices, as buyers still need to compete for the well-priced properties. Those listings being offered at prices based on winter sales may be too high for this market, so basing prices off of recently sold properties, “comps,” is best. When there is more demand, bidding wars drive sale prices up, but as the year goes on and fewer buyers are out there as many from the beginning of the year have found homes or renewed their leases, sellers may have to adjust prices to attract more buyers.

Buyers in the current real estate market are determined to find the ideal home that fits their needs and budget. However, rising rates and prices have impacted their affordability, making it a key concern. Therefore, it is crucial for buyers to closely monitor interest rates and keep their pre-approvals up to date. By doing so, they can act swiftly and be ready to strike at opportunities, especially if there is a drop in rates.

The commission class action settlement aims to restructure how real estate commissions are handled, causing some market confusion. Previously, sellers paid commissions for both their agent and the buyer’s agent from the sale proceeds. Starting in August, sellers may only need to pay for their agent’s commission, while buyers would pay out of pocket for their agent’s fees. This would have impacted VA buyers since VA rules prohibited them from being charged a brokerage fee, but a temporary amendment allows these benefits to continue despite the changes. Buyer affordability may be further impacted since this fee cannot be included in the mortgage.

As it is an election year, the political landscape might slow down the real estate market this winter, but a faster-paced market is anticipated for 2025 once the changes settle.

As we reach midyear, sellers encounter a blend of favorable and challenging market conditions. Traditionally, the first half of the year is a seller’s market, benefiting those looking to sell their properties. However, as we transition into the latter half of the year, the market typically shifts towards a buyer’s market, especially for those who are both selling and buying. Despite this shift, it remains advantageous to list your property now.

The advantages of homeownership outweigh the increasing costs because, ultimately, rents also tend to rise. Firstly, owning your own home, whether it’s a condo, single-family, or multi-family, grants you full control over your living space. It becomes entirely yours to customize and utilize as you wish. Secondly, homeownership offers the benefit of a fixed monthly payment, which leads to the third advantage of asset growth. With predictable monthly payments, you have the security of knowing what to expect, without the worry of sudden increases imposed by a landlord. Moreover, as you make those payments, you are building equity for yourself, not someone else. Lastly, in many instances, mortgage interest is tax deductible, allowing you to write off the interest you pay, this is particularly advantageous during the early stages of the loan when the interest portion of the payment is higher.

Data provided by Warren Group & MLS PIN then compared to the prior year.