This Lamacchia Mid-Year Housing Report presents overall home sale statistics as of the first six months of 2024 compared to the same period last year, January 1st to June 30th, 2023. Highlighted in this report are the average sale prices for single-family and condo/townhomes in South Florida (Miami – Fort Lauderdale – West Palm Beach MSA) along with the number of homes listed for sale and newly pending.

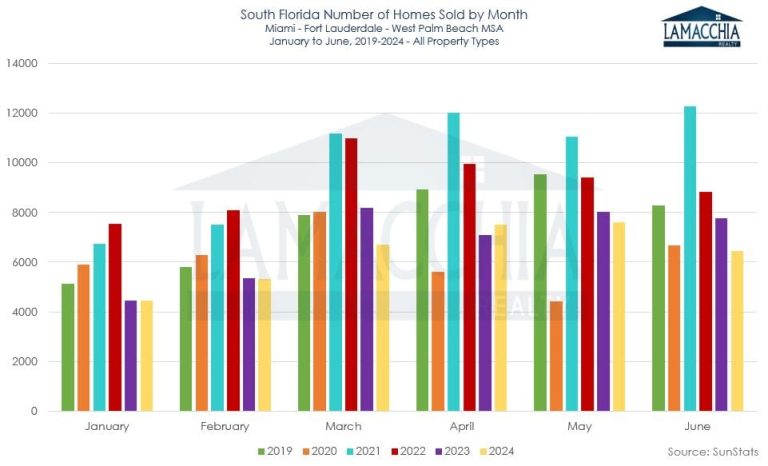

Number of Homes Sold Decreased by 7.1%

Home sales decreased overall by 7.1% for Miami – Fort Lauderdale – West Palm Beach MSA- there were 40,626 sales in the first part of this year and 37,744 in the same timeframe last year.

- Sales declined for both categories; single families are down 1.3% bringing sales to 18,960 from 19,212. Condo/townhome sales are down 12.3%; there were 21,414 in the first half of last year and 18,784 in the first half of this year.

- While sales dipped slightly in the first half of 2024, the decline was far less pronounced than the steep 25.5% drop experienced during the same period in 2023.

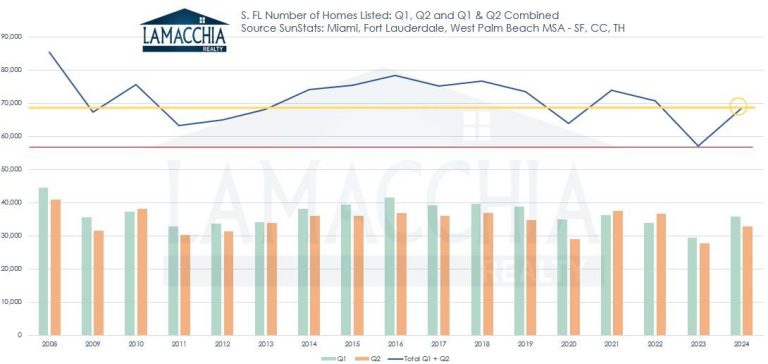

- Active inventory in South Florida has made a giant leap and is back up to

levels from the fall of 2020. Those work-from-anywhere jobs have returned to a form of hybrid or fully back to the office. Some owners have experienced difficulty with rising insurance premiums or condo regulations and assessments. See the yellow line in the graph to the right, and how it’s significantly higher than the last few years.

levels from the fall of 2020. Those work-from-anywhere jobs have returned to a form of hybrid or fully back to the office. Some owners have experienced difficulty with rising insurance premiums or condo regulations and assessments. See the yellow line in the graph to the right, and how it’s significantly higher than the last few years. - Condos & townhomes specifically are being listed faster than they are going under agreement which is greatly contributing to the rise in inventory levels we are currently seeing.

- The bar chart below depicts how sales in 2024 have struggled to keep up with 2023 and, in the end, came up behind.

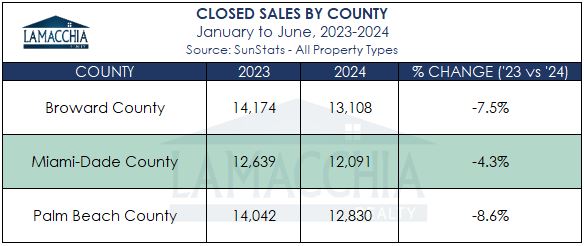

- The chart below illustrates how sales from January 1st to the end of June were down in each county.

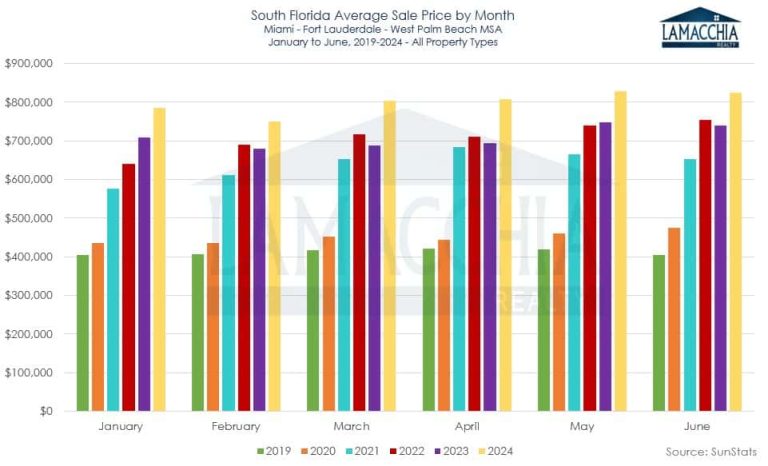

Prices Increase 13.1%

Average sale prices in South Florida have increased by 13.1% now at $808,686 over $714,846 in 2023 for Miami – Fort Lauderdale – West Palm Beach MSA.

- Single family prices are up by 13.9% and condo/townhomes are up by 6.5%. It’s expected with tight inventory that prices will increase due to buyer competition with bidding wars. The spike in inventory and a continual rise in prices, however, suggests that it’s the very high-end luxury sales swaying average sales price data.

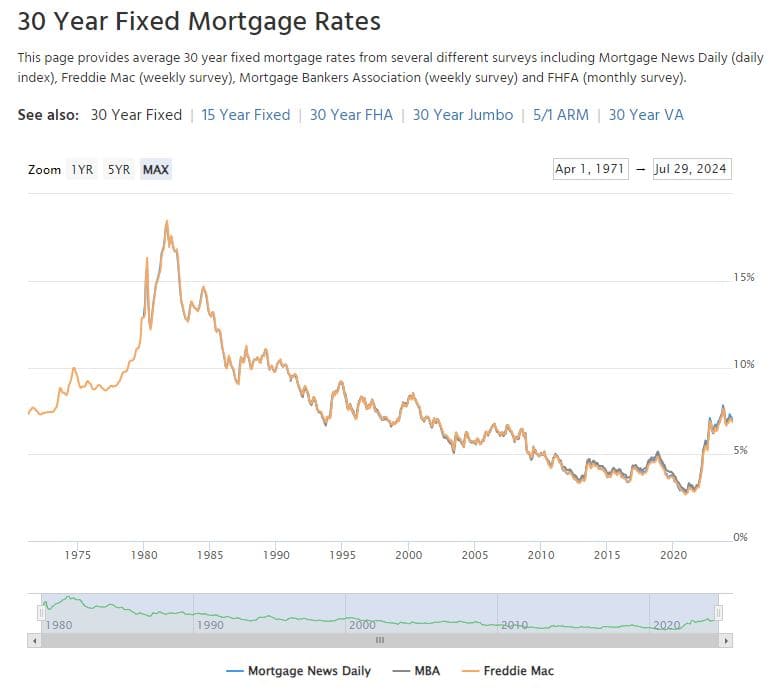

- That said, for most residential real estate in the region, sellers are well advised to list their homes competitively due to unprecedented affordability challenges for buyers. With home prices still elevated and mortgage rates hovering in the high 6% to low 7% range, buyers are facing financial strain.

- In the graph below, you can see that prices were up year over year in the first 6 months of 2024.

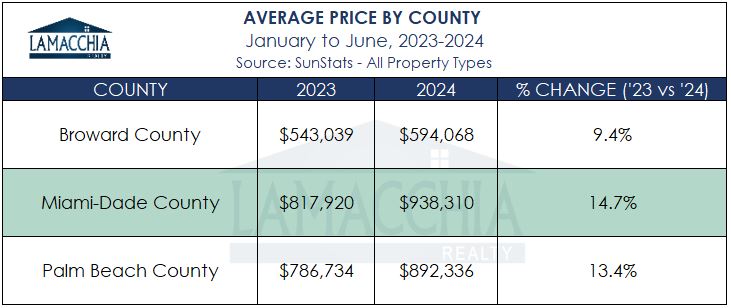

- The chart below shows how prices by county have increased year over year. It also shows the range of average prices from Broward, Miami-Dade, and Palm Beach Counties. You can see that the counties with a higher average price have pulled the average price up for the entire region.

- Mortgage rates continue to fluctuate, significantly influencing buyer and seller decisions. In South Florida, the impact is compounded by rapidly escalating insurance premiums and increased condo association fees. These additional costs, combined with rising mortgage rates, have created a challenging affordability landscape for potential homebuyers.

Homes Listed for Sale in South Florida

Listings overall increased by 19.1% in the first half of 2024 over the first half of 2023 now at 68,599 from 57,582.

- Last year, we published a report that covers the first half of 2023 which exhibited the least number of homes listed over a 6-month period (two consecutive quarters) since records have been kept (red line). This year, listings have taken a turn and increased back up to previous levels. The listings spike, indicated by the yellow line, started after the summer of 2023.

- New listings are outpacing the number of sales in South Florida, and pending sales are down, meaning homes are being listed faster than they are going under agreement.

- The year-over-year increase demonstrates that while many sellers aim to maintain pandemic-era interest rates, life events often necessitate a move. Factors such as divorce, expanding families, empty nesting, relocations, and financial changes compel both buyers and sellers to enter the market.

Pending Home Sales (contracts accepted)

Pending home sales in South Florida decreased by 8.4% over this timeframe in 2023. There were 44,683 pending sales in 2024 compared to 48,802 in 2023.

- Mortgage rates have reduced buyer affordability, along with inflation, increased insurance premiums, and special assessments. Some buyers have bailed on buying and have opted to rent for the time being.

- Rising regulatory costs are driving up expenses for condo and townhouse owners through increased HOA fees, special assessments, and homeowners’ insurance premiums. Consequently, many current owners are opting to sell their properties rather than absorb these additional burdens. Prospective buyers are also facing challenges with affordability due to increased mortgage rates and home prices, making condo associations less attractive options. As a result, we anticipate a decline in buyer demand for condos and townhouses, leading to price adjustments and longer on-market times. These factors all contribute to lower pending sales.

- When higher interest rates create affordability challenges for buyers, exploring options like mortgage buydowns or assumptions can be beneficial.

- Pending sales performance is relative to future closed sales and at this rate, sales may still be down year over year come fall.

Predictions for the Rest of the Year

South Florida mirrors national and regional trends with declining sales and rising home prices. While some sellers are reluctant to part with their low pandemic-era interest rates, increased listings indicate a growing number of homeowners are prioritizing life changes over financial considerations.

Strong buyer demand continues to support elevated prices, but sellers must accurately price their homes based on recent sales, or “comps,” to attract buyers. As the market matures, competition may soften, requiring potential price adjustments in some regions.

Buyers face affordability challenges due to higher rates and prices, emphasizing the importance of pre-approval and market monitoring. By doing so, they can act swiftly and be ready to strike at opportunities, especially if there is a drop in rates.

The real estate commission settlement is introducing changes to how agent fees are structured. While the initial impact on VA buyers has been temporarily mitigated, the overall effect on buyer affordability remains to be seen.

The upcoming election may introduce market uncertainty this winter, with a potential surge in activity anticipated for 2025.

Traditionally, the first half of the year is favorable for sellers. As we move into the second half, conditions may lean more towards buyers, especially for those looking to both buy and sell. Despite this shift, listing a property now offers advantages.

While costs are rising, the benefits of homeownership, including control of your own domain, financial stability, asset growth, and potential tax advantages, still outweigh the challenges.

Data provided by SunStats then compared to the prior year.