CONNECTICUT

Home Sales Up, Average Price Up

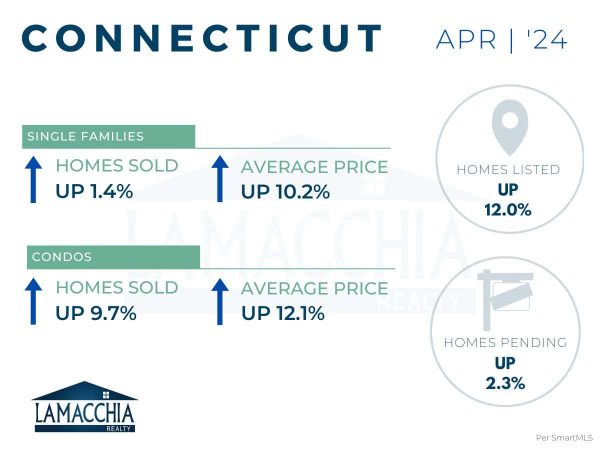

Home sales are up 3.4% year over year, with April 2024 at 2,453 compared to 2,373 last April. Home sales are up across all categories.

- Single families: 1,806 (2023) | 1,831 (2024)

- Condominiums: 567 (2023) | 622 (2024)

Average sale price has increased by 9.7% compared to last year, now at $558,470 from $509,187. Prices increased for all categories.

- Single families: $570,520 (2023) | $628,738 (2024)

- Condominiums: $313,937 (2023) | $351,849 (2024)

Homes Listed For Sale:

The number of homes listed is up by 12.0% when compared to April 2023.

- 2024: 4,022

- 2023: 3,591

- 2022: 5,334

Pending Home Sales:

The number of homes placed under contract is up by 2.3% when compared to April 2023.

- 2024: 2,986

- 2023: 2,919

- 2022: 3,920

Data provided by SmartMLS then compared to the prior year.

What’s Happening in the Market?

The housing market in Connecticut showed signs of a spring awakening in the month of April. New listings and the number of homes sold are up when compared to this time last year. Active inventory is on the rise, and so is average sale price. Mortgage rates continue to play a crucial role in consumer decision-making as they climbed to over 7.5% toward the end of the month per Mortgage News Daily.

What does this mean for Buyers?

As more and more sellers put their homes on the market, the more options buyers will have to choose from. There is still tremendous buyer demand in the market right now, and a lot of serious buyers have been waiting for the opportunity to strike. Hopefully, an increase in inventory (i.e., supply) leads to a potential lessening of competition in the market. Also, many buyers are still facing affordability issues especially with average sale price not showing any sign of dropping dramatically anytime soon. However, as inventory continues to increase, this should help to slow price appreciation.

In the face of ever-changing mortgage rates, buyers now more than ever need to make sure they understand every financing option available to them – assumptions, buydowns, ARMs, etc. – to make sure they can accomplish their buying goals this spring!

What does this mean for Sellers?

The winter deters a lot of want-to-be-sellers from listing their homes, but now that it is spring, this is typically when we see sellers come out in droves. The allure of nice weather, better curb appeal, longer days, etc. all prompt sellers to get back into the market. The new season also encourages many sellers who have been hesitating to list their homes to finally make a lifestyle change such as downsizing, relocating for work, retirement, etc. All this being said, sellers need to understand that as more inventory comes on the market, more options become available to buyers. There is still a considerable amount of competition in the market, but as more supply gets added, that will help satisfy the constant demand we are seeing. Therefore, pricing your home competitively will ensure you generate the most demand for your home which will ultimately help to make sure you get the most money for their home.

What’s next?

As the spring months roll on, we expect home sales and inventory to continue to increase as we typically see an uptick in market activity this time of year. However, the trajectory of the spring market will continue to be impacted by mortgage rates as they weigh so heavily in the decision-making process of both buyers and sellers. It doesn’t really benefit anyone to wait until ‘mortgage rates drop’ as there are no signs of that happening in the foreseeable future. It’s more likely that this level is the new normal, so moving on with real estate goals sooner rather than later would be lucrative for both buyers and sellers. Refinancing down the line is an option for homeowners should rates decrease.