CONNECTICUT

Home Sales Down, Average Price Up

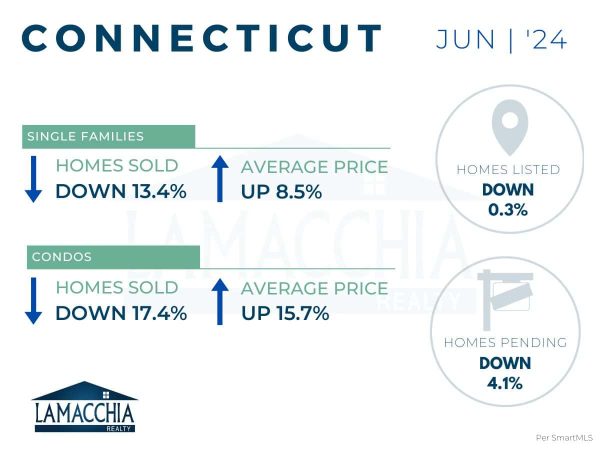

Home sales are down 14.3% year over year, with June 2024 at 3,227 compared to 3,764 last June. Sales are down across all categories.

- Single families: 2,931 (2023) | 2,539 (2024)

- Condominiums: 833 (2023) | 688 (2024)

Average sale price has increased by 9.9% compared to last year, now at $613,409 from $558,116. Prices increased for all categories.

- Single families: $622,502 (2023) | $675,682 (2024)

- Condominiums: $331,642 (2023) | $383,685 (2024)

Homes Listed For Sale:

The number of homes listed is down by 0.3% when compared to June 2023.

- 2024: 4,100

- 2023: 4,111

- 2022: 5,929

Pending Home Sales:

The number of homes placed under contract is down by 4.1% when compared to June 2023.

- 2024: 3,284

- 2023: 3,423

- 2022: 4,220

Data provided by SmartMLS then compared to the prior year.

What’s Happening in the Market?

- Home sales in Connecticut were down in June while average sale price continued its upward trajectory – aligning with national housing market data for the month.

- The market is shifting slowly from a seller’s market to a buyer’s market. With more and more sellers putting their homes on the market, the intense level of competition we have been seeing in the market is waning. Reason being, more inventory means more choices for buyers. Also, there are fewer buyers out now compared to the beginning of the year as many have either found a home already or have decided to renew their leases.

- Even though inventory is steadily increasing, the levels are still not high enough to adequately meet the demand in the market, meaning prices are not expected to drop any time soon. Rising home prices and higher mortgage rates continue to pose a significant strain on buyer affordability. However, as more and more inventory gets added to the market, price growth should slow with it.

- For sellers, more inventory means more competition, especially with fewer buyers in the market. Therefore, pricing your home competitively is critical to generate the most demand for your home to get it sold quickly and for the most money.

- Remember, homes will generally not sell for as much as they did at the beginning of the year when inventory was tight and buyers were out in droves leading to bidding wars, so basing prices off of recently sold properties, “comps,” is best.

- Many are waiting for a significant “drop” in mortgage rates, but current market trends suggest that these rates may hold steady for the foreseeable future and become the new “normal”. As such, buyers need to stay prepared and informed of the financing options available to them to make sure they are ready when the time is right!